AI in ENT Practices: What Works and What’s Just Hype

Discover key insights from Dr. Dunn on practical, proven uses of AI in otolaryngology practices—and how ENT-Cloud’s All In Intelligence helps doctors focus on care.

Cut through the complexity of ENT practice management with one unified EHR platform—streamlining notes, procedures, claims, and scheduling so you can stay fully focused on patient care.

At ENT-Cloud, we’re All In Intelligence—because built-in intelligence creates real freedom and reduces the friction that slows otolaryngology practices down.

From intake to charting to claims, our agents handle administrative weight so you don’t have to.

Every tool connects in one platform, eliminating extra logins, duplicate entry, and hidden add-ons across your clinical, audiology, allergy, and otolaryngology workflows.

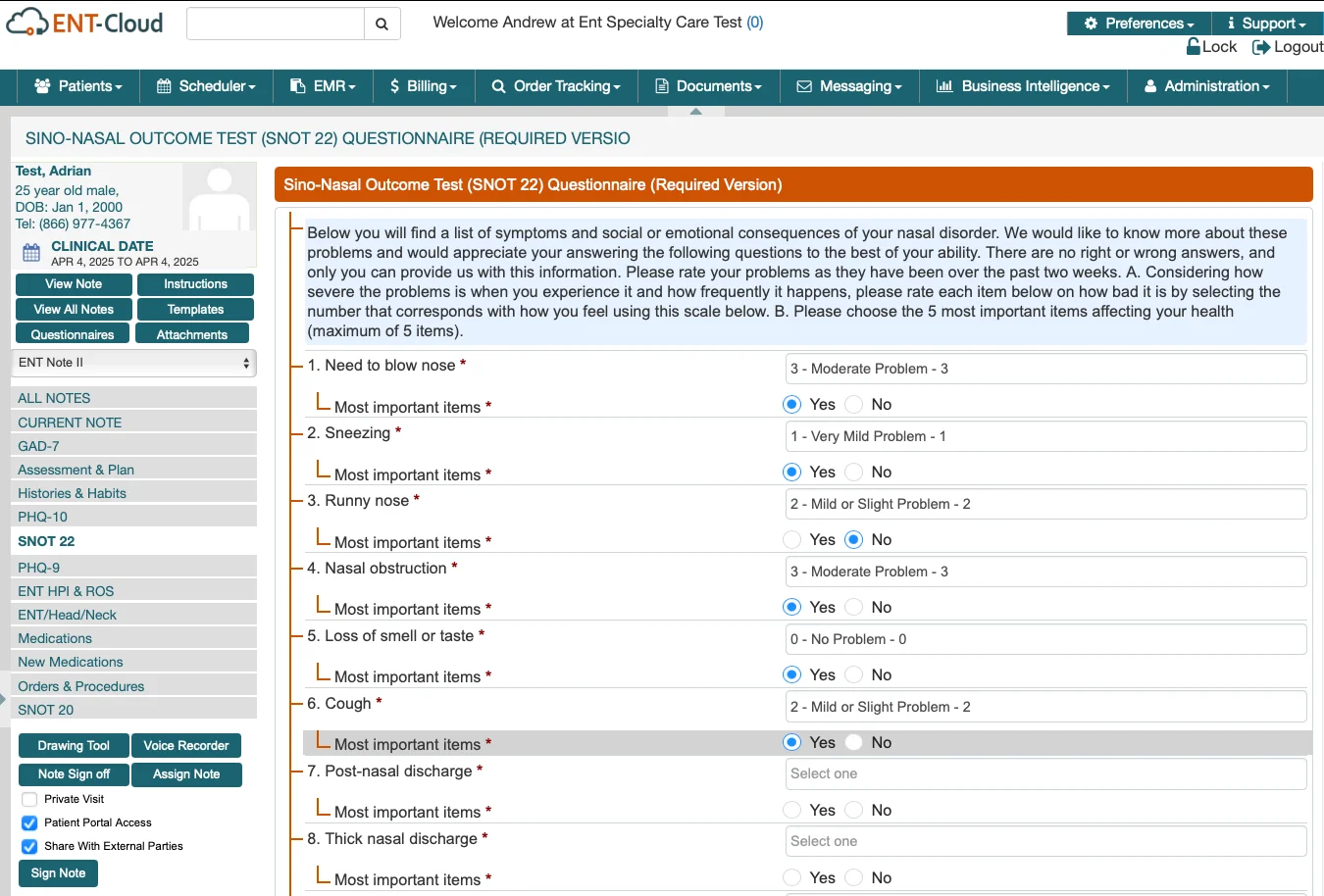

Designed with practicing clinicians, our EHR supports the daily demands of ENT care: high-volume visits, multiple-complaint encounters, in-office procedures, allergy management, and hearing services.

The result: fewer administrative headaches, faster documentation, and more time for meaningful patient care.

ENT-Cloud combines ENT-focused workflows with intelligent automation that anticipates what your team needs, reduces wasted time, and simplifies the business side of running a high-volume practice.

Visits end, but the work doesn’t. After examining ears, reviewing audiology results, or performing a nasal endoscopy, another detailed note waits—and the next patient is already roomed. Evenings disappear into catch-up charting.

You can finally break that pattern.

With WRS MobileMD Scribe, your notes draft themselves in real time. Endoscopy findings, otoscopy details, audiology summaries, and prior visit context are pulled in automatically. You review, sign, and move on—without taking hours of documentation home.

Need structured templates? The ENT-Cloud platform includes a full library built for otolaryngology: sinusitis, otitis media, vertigo, allergy evaluations, laryngoscopy, post-op visits, and more. Create your own reusable templates when you need something custom.

Improved Pre-Visit Intake

River ENT faced ongoing delays tied to insurance verification and patient intake. With ENT-Cloud and Virtual Assistants handling verification, registration, and front-end workflows, the practice achieved 100% eligibility verification, reduced bottlenecks, and improved the patient experience across the board.

Perfect MIPS Performance

Coastal ENT struggled with tracking requirements, documentation accuracy, and staying ahead of MIPS reporting. With ENT-Cloud’s built-in compliance tools and support from our billing and reporting team, the practice reached a 100% MIPS score and strengthened its overall operational performance.

You do everything right, yet the claim comes back denied. Modifiers get flagged. Multiple procedures are reduced. Surgical claims linger. Staff spend hours chasing payors, delays pile up, and patient frustration grows.

Built-in coding support and eligibility checks prevent issues before they happen. Claims go out clean, payments return faster, and your revenue cycle becomes predictable again.

Need additional support? Our billing services deliver industry-leading results*:

*Results based on individual clients. Metrics may vary.

ENT-Cloud supports the full spectrum of care and delivers an EHR for otolaryngology that helps manage clinic visits to procedures, allergy, audiology, and surgery.

Discover key insights from Dr. Dunn on practical, proven uses of AI in otolaryngology practices—and how ENT-Cloud’s All In Intelligence helps doctors focus on care.

Discover how ENT-specific solutions can improve your revenue cycle and lessen the burden on your staff.

A strong online reputation builds trust, attracts new patients, and strengthens your brand. Learn seven proven ways to manage your ENT practice reputation.